Global market for dental implants and prosthetics

Dublin, Nov. 17, 2022 (GLOBE NEWSWIRE) — U.S Dental Implants and Prosthetics Market by Type (Dental Implants (Titanium, Zirconium), Dental Prosthetics (Dental Bridges, Crowns, Dentures, Veneers, Inlays & Inlays), Facility Type (Hospitals, Clinics, Dental Labs) – Global Forecast 2027 to “ reference has been added to ResearchAndMarkets.com’s special offer.

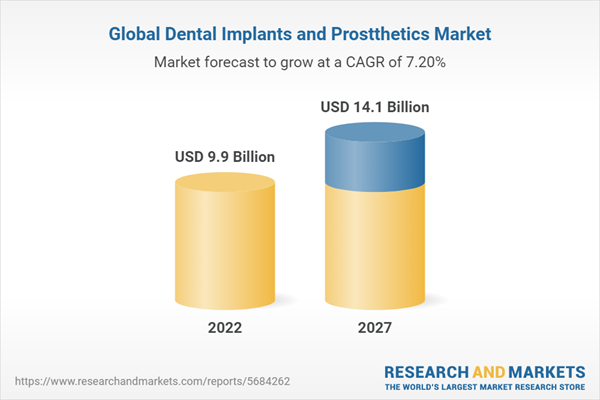

The dental implants and prosthetics market is projected to reach US$ 14.1 billion by 2027 from US$ 9.9 billion in 2022, at a CAGR of 7.2% during the forecast period.

The premium implant segment held the largest share in the dental implant market

On the basis of price, the dental implants market is segmented into premium implants, value implants, and discount implants. In 2021, the premium implants segment held the largest share of the dental implants market. The large share of premium implants is mainly due to their higher adoption in developed countries such as the US, Germany and Japan.

In 2021, dental bridges held the largest share in the dental prosthetics market, by type

The dental prosthetics market, by type, is segmented into dental crowns, dental bridges, dentures, abutments, veneers, and inlays and inlays. In 2021, dental bridges held the largest share in the dental prosthetics market, by type. The large share of dental bridges is mainly due to the fact that dental bridges are cost-effective alternatives to single-tooth implants and can also cover multiple missing teeth. However, the use of bridges in dental restorative procedures carries the risk of wearing away the bone surrounding the previously missing tooth. Additionally, bridges are more prone to plaque build-up and gum disease.

Hospitals and clinics held the largest share of dental implants and prosthetics market in 2021

On the basis of facility type, hospitals and clinics held the largest share of the dental implants and prosthetics market in 2021. The increasing number of dental clinics and hospitals in developing countries (such as India and China) is expected to offer lucrative growth opportunities to players active in the market of dental implants and prosthetics.

The Asia Pacific region is expected to register the highest CAGR in 2021

On the basis of geography, the dental implants and prosthetics market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The growth of the Asia-Pacific dental implants and prosthetic dental implants market is mainly driven by the rapid growth of the geriatric population, booming medical tourism, and higher demand for cosmetic dentistry.

Key topics covered:

1 Introduction

2 Research Methodology

3 Summary

4 Premium Insights

4.1 Dental Implants and Prosthetics Market Overview

4.2 Asia Pacific: Dental Implants and Prosthetics Market, 2021

4.3 Dental Implants and Prosthetics Market: Geographical Mix

4.4 Dental Implants and Prosthetics Market: Developed vs. Developing Countries

5 Market overview

5.1 Introduction

5.2 Market Dynamics

5.3 Market Dynamics: Impact Analysis

5.3.1 Drivers

5.3.1.1 Increasing incidence of dental diseases

5.3.1.1.1 Dental caries and other periodontal diseases

5.3.1.1.2 Teething

5.3.1.2 Increasing demand for cosmetic dentistry

5.3.1.3 Growing Dental Tourism in Emerging Markets

5.3.1.4 Improving Disposable Income in Developing Countries

5.3.1.5 Development of Technologically Advanced Solutions

5.3.1.6 Changing lifestyle and unhealthy eating habits

5.3.1.7 Increasing consumer awareness and increasing focus on aesthetics

5.3.2 Limitations

5.3.2.1 High cost of dental implants and limited reimbursements

5.3.2.2 Greater risk of tooth loss associated with dental bridges

5.3.3 Opportunities

5.3.3.1 Low penetration rate of dental implants in developing countries

5.3.3.2 Increase investment in Cad/Cam technologies

5.3.4 Challenges

5.3.4.1 Lack of trained dentists

5.3.4.2 Pricing pressure faced by prominent market players

5.4 Industry Trends

5.4.1 Increasing market consolidation

5.4.2 Increasing focus on product development and launch

5.4.3 Increasing number of Industry-Academia Collaborations

5.4.4 US Dental Insurance

5.4.5 Robotic Dentists and A

5.5 Technology Analysis

5.6 Pricing Analysis

5.6.1 Average selling price, by type

5.6.1.1 Premium Implants

5.6.1.2 Value Implants

5.6.1.3 Discounted Implants

5.7 Value Chain Analysis

5.8 Ecosystem Market Map

5.9 Porter’s Five Forces Analysis

5.10 Supply Chain Analysis

5.11 Regulatory Analysis

5.12 Patent Analysis

5.13 Adjacent Market Analysis

5.14 Key Conferences & Events during the period 2022-2024

5.15 Regulatory Bodies, Government Agencies and other Organizations

5.16 Key stakeholders and purchase criteria

6 Buy Dental Implants

6.1 Introduction

6.2 Dental Implants Market, by Material

6.2.1 Titanium implants

6.2.1.1 Purchase of titanium implants, by process

6.2.1.1.1 Two-step process

6.2.1.1.1.1 Time-consuming and expensive nature of two-step processes to limit growth

6.2.1.1.2 One Stage Process

6.2.1.1.2.1 Growing preference for better aesthetics and greater demand for less time-consuming procedures to promote growth

6.2.1.2 Purchase of titanium implants, from Connector

6.2.1.2.1 External hexagonal joints

6.2.1.2.1.1 Higher strength and durability to increase demand for external hex connections

6.2.1.2.2 Internal hexagonal joints

6.2.1.2.2.1 Higher esthetic value for the adoption of external hex connectors for cosmetic dentistry

6.2.1.2.3 Internal octagonal joints

6.2.1.2.3.1 Ability to Eliminate Adverse Effects of Force Distribution in Prosthetic Screws and Implant Screws to Promote Adoption

6.2.2 Zirconium Implants

6.3 Purchase of Dental Implants, by Design

6.3.1 Tapered dental implants

6.3.1.1 Advantages such as improved primary stability in soft bones and immediate recovery in fuel development

6.3.2 Parallel wall dental implants

6.3.2.1 Postoperative complications associated with parallel-wall implants for growth restriction

6.4 Dental Implants Market, by Type

6.4.1 Dental implants of root form

6.4.1.1 High success rate and durability of root-form implants for growth promotion

6.4.2 Dental implants in plate form

6.4.2.1 High cost of plate implants to limit demand

6.5 Purchase of Dental Implants, by Price

6.5.1 Premium Implants

6.5.1.1 Long-term use and success of Premium implants in driving demand

6.5.2 Value Implants

6.5.2.1 Increasing dental tourism in emerging countries to promote the market

6.5.3 Discounted Implants

6.5.3.1 The cost-effectiveness of discounted implants to promote adoption

7 Buy Dental Prosthetics

7.1 Introduction

7.2 Bridges

7.2.1 Bridges Market, by Type

7.2.1.1 Bridges of 3 units

7.2.1.1.1 Potential for bone resorption and bacterial decay to affect adoption of 3-unit bridges

7.2.1.2 Bridges of 4 units

7.2.1.2.1 Increasing number of root canal procedures to increase demand for 4-unit bridges

7.2.1.3 Maryland Bridges

7.2.1.3.1 Low Cost Maryland Bridges to Drive Market

7.2.1.4 Cantilever bridges

7.2.1.4.1 Increased use of single-tooth implants leading to decreased adoption of cantilever bridges

7.3 Crowns

7.3.1 High durability of dental crowns to increase demand

7.4 Dental Bridges & Crowns Market, by Material

7.4.1 Porcelain-Narrowed-Metal

7.4.1.1 High Strength and Stability and Low Cost to Promote the Market for Pfm Crowns and Bridges

7.4.2 All-ceramics

7.4.2.1 Better dental esthetics offered by all-ceramic crowns and bridges for fuel development

7.4.3 Metal

7.4.3.1 Ability to withstand heavy biting and chewing forces to drive adoption

7.5 Dentures

7.5.1 Partial dentures

7.5.1.1 Growing Denture Population to Increase Demand for Partial Dentures

7.5.2 Complete dentures

7.5.2.1 Longer healing process to limit demand for complete dentures

7.6 Veneers

7.6.1 Growing demand for cosmetic dentistry will boost the veneers market

7.7 Inserts & Inserts

7.7.1 Increasing use of Cad/Cam technologies to manufacture inlays & onlays to support development

8 Purchase of Dental Implants and Prosthetics, by Facility Type

8.1 Introduction

8.2 Hospitals & Clinics

8.2.1 Increasing Number of Dental Clinics and Hospitals to Support Market Growth

8.3 Dental Laboratories

8.3.1 Increase Outsourcing of Manufacturing Functions in Dental Laboratories to Drive Market

8.4 Other facilities

9 Dental Implants and Prosthetics Market, by Region

10 Competitive Landscape

10.1 Overview

10.2 Strategies of Key Players

10.3 Revenue Share Analysis of Leading Market Players

10.4 Market Share Analysis

10.5 company rating quadrant

10.5.1 Stars

10.5.2 Emerging Leaders

10.5.3 Pervasive Players

10.5.4 Participants

10.6 Company Rating Quadrant for Startups

10.6.1 Progressive Companies

10.6.2 Dynamic Companies

10.6.3 Startup Block

10.6.4 Responding Companies

10.7 Corporate Product Footprint

10.8 End User Footprint of Major Players

10.9 Local Footprint of Significant Players

10.10 Competitive Benchmarking

10.11 Competitive Scenario

10.11.1 Product Presentations

10.11.2 Offers

10.11.3 Other Developments

11 Company Profiles

11.1 Key Players

11.1.1 Institut Straumann Ag

11.1.1.1 Business Overview

11.1.1.2 Offered Products

11.1.1.3 Recent Developments

11.1.1.4 Analyst View

11.1.1.4.1 Right to Win

11.1.1.4.2 Strategic Options

11.1.1.4.3 Weaknesses and competitive threats

11.1.2 Envista Holdings Corporation

11.1.3 Dentsply Sirona Inc.

11.1.4 3M Company

11.1.5 Zimmer Biomet Holdings, Inc.

11.1.6 Henry Schein, Inc.

11.1.7 Mitsui Chemicals, Inc.

11.1.8 Coltene Group

11.1.9 Ivoclar Vivadent Ag

11.1.10 Avinent Implant System

11.1.11 Osstem Implant Co. Ltd.

11.1.12 Bicon, LLC

11.1.13 Dental Implant Systems Adin

11.1.14 Dio Corporation

11.1.15 Thommen Medical Ag

11.2 Other Players

11.2.1 Septodont Holding

11.2.2 Southern blots

11.2.3 Keystone Dental, Inc.

11.2.4 Bego GmbH & Co Kg

11.2.5 Ultradent Products, Inc.

11.2.6 Voco GmbH

11.2.7 Dmg Chemisch-Pharmazeutische Fabrik GmbH

11.2.8 Shofu Inc.

11.2.9 Bisco, Inc.

11.2.10 Dental Technologies Inc.

12 Appendix

For more information on this report visit https://www.researchandmarkets.com/r/h7nsv

Attached

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900