Macklowe paid $32 million for the property and financed the transaction with a $39 million loan.

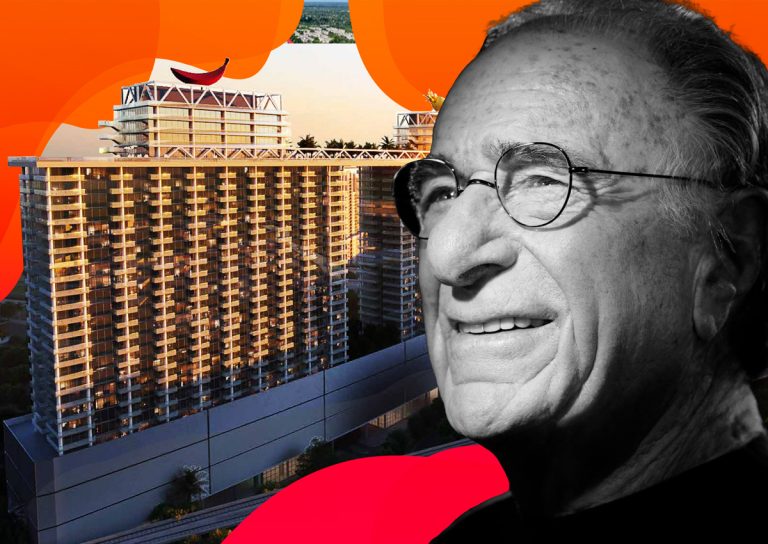

Harry Macklowe

New York developer Harry Macklowe is looking to sell one of his Miami development sites, The real deal has learned.

The 1.7-acre strip of land, facing U.S. 1, between Simon Property Group’s Dadeland Mall and Jeff Berkowitz’s Dadeland Station, marked Macklowe’s arrival. first major purchase in South Florida when he acquired it about two years ago.

THE property is approved for 770 residential units distributed in two 25-story towers. A number of new apartment towers have recently been built or are planned in the area.

Macklowe brought in a Berkadia team led by Jaret Turkell, Roberto Pesant and Omar Morales to list the site near Dadeland Mall without a price, according to the listing. The brokers declined to comment. Macklowe did not respond to requests for comment.

A company linked to Macklowe paid $31.9 million for the Dadeland location in April 2022 and financed the deal with a $39.2 million loan from Fortress Investment Group.

A number of promoters and investors have put their development sites up for sale in recent months, in part because of high interest rates, construction costs and soaring expenses like insurance. Land prices sharp between 2021 and 2022, and started to decline in the second half of 2022.

Macklowe, CEO of New York-based Macklowe Properties, has had his share of problems in New York. In the fall he seizure avoided of his personal residences at 432 Park Avenue after placing the entity that controls his interest in the units under bankruptcy protection. He also fought a Hamptons zoning board over more than 20 code violations against his East Hampton home. The property, which the developer recently listed for $38 million, is uninhabitable because he does not have a certificate of occupancy.

In South Florida, Macklowe is also partnering on a joint venture development with Miami-based Related Group in North Bay Village. Macklowe’s involvement in the development of the waterfront land, including the purchase of a waterfront co-op and units in an older condo building deemed unsafe, has been mired in litigation. That of the Pérez family Related is leading the planned development of the assemblage, which is expected to include hundreds of luxury condos.